Bankruptcy code

Bankruptcy Code presented in Rajya Sabha in Dec 2015 and supposed to be passed in 2016 Budget Session.

OBJECTIVES

- to consolidate the laws relating to insolvency, reorganization and liquidation/ bankruptcy of all persons, including companies, individuals, partnership firms and Limited Liability Partnerships (LLPs) under one statutory umbrella and amending relevant laws;

- time bound resolution of defaults and seamless implementation of liquidation/ bankruptcy and maximizing asset value;

- to encourage resolution as means of first resort for recovery;

- creating infrastructure which can eradicate inefficiencies involved in bankruptcy process by introducing National Company Law Tribunal (NCLT), Insolvency Resolution Professional Agencies (IPAs), Insolvency Professionals (IPs) and Information Utilities (IUs).

SALIENT FEATURES

1. Unified Legislation

2. Code Mandated Infrastructure

- Insolvency Regulator

The Code seeks to establish an Insolvency and Bankruptcy Board of India (Board) which will function as the regulator for all matters pertaining to insolvency and bankruptcy. The Board will exercise a range of legislative, administrative and quasi-judicial functions. Some of the primary functions of the Board will include regulating entry, registration and exit of IPAs, IPs and IUs in the field of insolvency resolution, setting out eligibility requirements for such entities, making model bye laws for IPAs, setting out regulatory standards for IPs, specifying the manner in which IUs can collect and store data, and generally acting as the regulator overseeing the resolution process in the manner specified under the Code. - Insolvency Adjudicating Authority

The Code specifies 2 different adjudicating authorities (the Adjudicating Authority) which will exercise judicial control over the insolvency process as well as the liquidation process.

In case of companies, LLPs and other limited liability entities (which may be specified by the Central Government from time to time), the NCLT shall be acting as the Adjudicating Authority. All appeals from NCLT shall lie with the appellate authority, i.e. the National Company Law Appellate Tribunal (NCLAT).

In case of individuals and partnerships, the Adjudicating Authority would be the Debt Recovery Tribunal (DRT) with the Debt Recovery Appellate Tribunal (DRAT) continuing to be the appellate tribunal even for insolvency/ bankruptcy matters. The Supreme Court of India shall have appellate jurisdiction over NCLAT and DRAT. - Insolvency Professionals

Under the Code, IPs will be the licensed quasi-administrators who will carry out on ground supervision of resolution process, manage affairs and assets of the debtor during the process, receive and finalise resolution plans with the committee of creditors (COCs) and carry out the liquidation/bankruptcy of the debtor if the trigger for liquidation/bankruptcy (as set out below) gets activated. - Insolvency Professional Agencies

The IPAs will admit IPs, prepare model of code of conduct, establish performance standards for IPs, redress customer grievances against the IPs and act as a disciplinary body for all IPs registered with them. - Information Utilities

One of the dilatory factors plaguing the existing winding up proceedings has been the time taken by the courts in deciding whether a debt exists or not. In order to address this issue in an objective way, the Code seeks to put in place a robust infrastructure of IUs with an aim to have such information readily available for an Adjudicating Authority to rely upon. IUs are expected to collect, classify, store and distribute all possible relevant data pertaining to the debtors to/from companies and financial and operational creditors of a debtor, including but not limited to the data on financial defaults. However, the specific nature of data required to be managed by IUs will be clarified only when the rules under the Code will be notified.

3. Corporate Insolvency

- Meaning and Scope

Part I of the Code deals with corporate insolvency mechanism pertaining to limited liability entities including companies, LLPs and other limited liability entities (Corporate Insolvency) as may be notified from time to time; but does not include any financial service provider. Corporate Insolvency includes two processes within its ambit, (i) Insolvency Resolution and (ii) Liquidation. - Strict Timelines

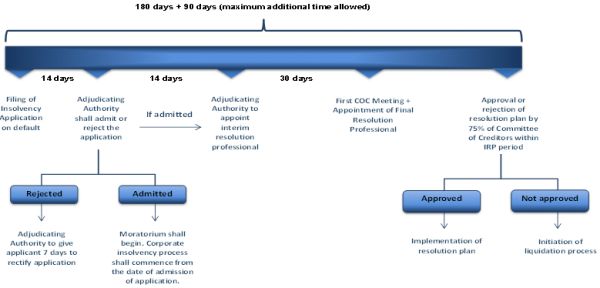

The Code prescribes a timeline of 180 days for the insolvency resolution process, which begins from the date the application is admitted by the NCLT. The period is subject to a single extension of 90 days in the event the Adjudicating Authority (being petitioned by a resolution passed by a vote of 75% of the COC) is satisfied that the corporate insolvency resolution process cannot be completed within the period of 180 days. This time period is also applicable to individual insolvency resolution process.

During this period, the creditors and the debtor will be expected to negotiate and finalise a resolution plan (accepted by 75% of the financial creditors) and in the event they fail, the debtor is placed in liquidation and the moratorium lifted. - Triggers for Insolvency Resolution Process (IRP)

In order to achieve quick resolution of distress, the Code prescribes certain 'early detection' triggers which can be activated on first signs of stress. The moment a default occurs, a financial creditor, an operational creditor or a corporate applicant may approach the Adjudicating Authority (i.e. NCLT) with an application for initiation of IRP. The procedure for these 3 group of applicants under the Code varies and are primarily as follows:- Financial Creditors: Financial creditors are those who extend financial debt to a corporate debtor or to whom a financial debt is assigned by a financial creditor. In case of a financial creditor, the moment a financial default occurs, the financial creditor can make an application to the NCLT for initiating IRP. The financial creditor for this purpose has to submit records of default with IU or evidence of such default in case the information is not available with IU.

- Operational Creditors: These are creditors to whom corporate debtor owes operational debt (including claims for goods and services, employment or dues to any government under any law) or to whom such debt is assigned by an operational creditor. The operational creditor may upon occurrence of a default on operational credit, serve a demand notice or invoice demanding payment on the corporate debtor. If the corporate debtor fails to make such payment within 10 (ten) days or fails to notify operational creditor of a dispute in relation to the requested payment, the operational creditor can make an application to NCLT along with demand notice/invoice and other documents as prescribed therein.

- Corporate Applicant: A Corporate applicant includes the corporate debtor (whose IRP is proposed to be initiated) or its shareholder, management personnel or employees satisfying certain criteria. A corporate applicant may file an application for IRP upon occurrence of any default and shall along with application submit its books of account and other documents to initiate the IRP.

- Transfer of Powers and Moratorium

The Code stipulates a statutory moratorium during the limited IRP period whereby no suits, proceedings, recovery or enforcement action may take place against the corporate debtor. However, the IP will be appointed as the resolution professional in terms of the procedure outlined in the Code, who will take over the management and powers of board of directors of the corporate debtor. All officers and managers of the corporate debtor are required to act on instructions of the IP and all accounts of the corporate debtor will be managed by it. - Committee of Creditors to chart the course during IRP

The COC shall only include financial creditors as decision makers (operational creditors with more than 10% aggregate exposure have mere observer status during the COC meetings) and shall be responsible for deciding the important affairs of the company. It shall also be responsible for authorising the IP (acting as resolution professional) to take (or not to take) certain actions such as raising interim finance upto the limit specified by the committee, creating security on assets of the secured creditor, undertaking related party transactions, amending constitutional documents, change of capital structure or management of the Borrower etc. More importantly, the COC shall approve the resolution plans received by the IP. All decisions of the COC are required to be approved by a majority of 75% of the voting shares/value of the financial creditors. - Liquidation

In the event that:- the COC cannot agree on a workable resolution plan within the IRP Period (i.e. 180 days extendable once by another 90 days);

- the COC decides to liquidate the company;

- the NCLT rejects the resolution plan; or

- the corporate debtor contravenes provisions of the resolution plan,

- pass an order requiring liquidation of corporate debtor;

- make a public announcement of corporate debtor entering liquidation; and

- require a liquidation order to be sent to the registering authority of the corporate debtor (for example Registrar of Companies in case of companies incorporated under Companies Act).

- Waterfall

In case of liquidation, the assets of the corporate debtor will be sold and the proceeds will be distributed amongst the creditors in the following order of priority:- cost of the insolvency resolution process and liquidation;

- secured creditors (who choose to relinquish their security enforcement rights and workmen's dues relating to a period of 24 months preceding the liquidation commencement date);

- wages and unpaid dues of employees (other than workmen) for a period of 12 months preceding the liquidation commencement date;

- financial debts owed to unsecured creditors;

- statutory dues to be received on account of Consolidated Fund of India or Consolidated Fund of a State (relating to a period of whole or part of 2 years preceding the liquidation commencement date) and debts of secured creditors (remaining unpaid after enforcement of security);

- remaining debts and dues;

- dues of preference shareholders; and

- dues of equity shareholders or partners (as may be applicable).

4. Individual Bankruptcy

- Scope and Threshold

Part III of the Code sets out the legal regime dealing with the insolvency mechanism for individuals and partnership firms and includes within its ambit, 3 processes, namely, the 'fresh start process', 'the insolvency resolution process' and 'bankruptcy'.

The threshold for applicability of Part III of the Code to individuals and partnership firms have been set at a minimum of INR 1,000. However, the Central Government may by notification increase the threshold to a minimum of INR 1,00,000. - Fresh Start Process

An application for a fresh start process, can be made for any debt (other than secured debt, debt which has been incurred 3 months prior to the date of application for fresh start process and any 'excluded debt').

The Code has introduced the concept of 'excluded debt' and 'excluded assets' for individuals and partnership firms under which certain debt and assets of the debtor would be exempted from the purview of fresh start process and the insolvency process under the Code. For example, any liability imposed by a court/tribunal, any maintenance required to be paid under any law and any student loan form a part of 'excluded debt'. Similarly, any unencumbered tools, books or vehicles of the debtor which are required for personal use, employment or vocation, unencumbered life insurance policies, pension plans, personal ornaments having religious sentiments and single dwelling unit of the debtor fall within the ambit of 'excluded assets'.- Eligibility criteria

The Code provides for stringent criteria for any debtor to be eligible to apply for a fresh start process under the Code. For example, any person who does not own a dwelling unit and has a gross annual income of less than INR 60,000, with assets of a value not exceeding INR 20,000, and the aggregate value of the qualifying debt of such individual or partnership firm not exceeding INR 35,000 shall be eligible to apply for a fresh start process. In addition, it is imperative that such applicant is not an undischarged bankrupt and there are no previous fresh start process or insolvency resolution process subsisting against him. - Moratorium

The Code stipulates an interim-moratorium period which would commence after filing of the application for a fresh start process and shall cease to exist after elapse of a period of 180 days from the date of application. During such period, all legal proceedings against such debtor should be stayed and no fresh suits, proceedings, recovery or enforcement action may be initiated against such debtor.

However, the Code has also imposed certain restrictions on the debtor during the moratorium period such as the debtor shall be not be permitted to act as a director of any company (directly/indirectly) or be involved in the promotion or management of a company during the moratorium period. Further, he shall not dispose of his assets or travel abroad during this period, except with the permission of the Adjudicating Authority.

- Eligibility criteria

- Insolvency Resolution Process

An application to initiate an IRP under the Code can be either made by the debtor (personally or through an insolvency resolution professional) or by a creditor (either personally or jointly with other creditors through an insolvency resolution professional).

However, a partner of a partnership firm is not eligible to apply for an IRP unless a joint application is filed by majority of the partners of the partnership firm.- Repayment Plan

In the IRP, the creditors and the debtor need to arrive at an agreeable repayment plan for restructuring the debts and affairs of the debtor, supervised by an IP. The repayment plan will require approval of a three-fourth majority of financial creditors in value.

The repayment plan may authorize or require the resolution professional to: (a) carry on the debtor's business or trade on his behalf or in his name; or (b) realize the assets of the debtor; or (c) administer or dispose of any funds of the debtor. - Moratorium

The Code prescribes a timeline of 180 days within which the Adjudicating Authority shall pass an order on the repayment plan and beyond such period, if no repayment plan has been passed by the Adjudicating Authority, the moratorium in respect of the debts under consideration under the IRP shall cease to have an effect.

- Repayment Plan

- Bankruptcy

The bankruptcy of an individual can be initiated by the debtor, the creditors (either jointly or individually) or by any partner of a partnership firm (where the debtor is a firm), only after the failure of the IRP or non-implementation of repayment plan. The bankruptcy trustee is responsible for administration of the estate of the bankrupt and for distribution of the proceeds on the basis of the priority set out in the Code.

5. Key Changes in the Insolvency/Liquidation Regime

- Decision Making in the Hands of Creditors

Presently, winding up of companies as envisaged in the Companies Act vests the decision on whether a company should be wound up or not on the wisdom of the High Court/NCLT. On the other hand, under the new regime, if the restructuring fails to be implemented as prescribed under the Code it would lead to automatic liquidation of the debtor (except in case of individuals). - Unsecured Creditors Vote at Par

Under the Code, each financial creditor of the COC, whether secured or not, gets to vote on the resolution plan of the corporate debtor on the basis of its voting share (proportionate to the money advanced by the creditor). - Government Dues Take Backseat

Under the Code, government dues including taxes rank lower than the unsecured creditors and wages as against the exiting regime, where after secured creditors and workmen dues, government dues including all taxes take preference on liquidation payouts. - Individual bankruptcy gets a shot in the arm

Currently, individual bankruptcy proceedings are adjudicated upon by district courts under 2 different statues. The Code proposes to unify the regime governing individual bankruptcy and in case where the individual bankruptcy is initiated alongside the corporate insolvency, NCLT will have jurisdiction to hear the matter relating to individual bankruptcy along with corporate insolvency. This is expected to speed up resolution on such matters. - Protection to workers

The Code protects the workers in case of insolvency, paying their salaries for up to 24 months in priority over all other creditors including secured creditors. This is a welcome change as in most cases of corporate insolvency, the workers and employees end up bearing the brunt of long drawn insolvency/bankruptcy process. - Incentive to Insolvency Professionals

In the distribution of liquidation proceeds, the cost of IP and the IRP has first priority, thereby acting as an incentive for them to strive for speedy resolution. This is at par with international practices. - Interim Financing

The Code prescribes that any interim financing and the cost of raising such financing will be included as part of the IRP cost, thereby giving it first priority in the waterfall and also in any creditor driven plan. Security can be created over the assets of the company to secure such financing by the interim resolution professional without the consent of existing creditor(s) if the value of the property secured in favour of existing secured creditors is at least twice the outstanding debt. However, any financing after the appointment of the resolution professional and constitution of the COC must be approved by 75% of the financial creditors by value. - Cross Border Insolvency

The Code for the first time attempts to addresses the issue of cross border insolvency given the multi-jurisdictional spread of assets of large corporates. In order to deal with this aspect, the Code stipulates a two pronged solution, one being the Central Government entering into agreements with other countries for enforcing the provisions of the Code and the other giving the Adjudicating Authority the authority to write a letter to the courts and/or authorities of other countries (as may be relevant) for seeking information or requesting action in relation to the assets of the debtor situated outside India.

6. Road Ahead

- Operational Issues

- Infrastructure Requirements: The Code proposes the establishment of the Board and NCLT, which if the government is able to set up even within a year will be laudable, considering the manpower/ facilities these institutions will require to perform their respective functions and the expertise and training they will need to do justice to the aims of the Code.

- Quality Professionals: Successful implementation of the Code will require a huge force of trained and skilled insolvency professionals. A strong focus and a well-defined plan will be needed to develop a large pool of insolvency professionals and an institutional structure which will produce, certify and regulate them. Such insolvency professionals will not only need to understand the nuances of restructuring/ liquidation but must also be capable of carrying out the affairs of the company during the process. This process will definitely take a substantial amount of time, resources and expertise. Moreover, effort will be needed to ensure that such professionals are available across the entire country and not just for high profile cases in financial hubs.

- Information Systems: The underlying assumption for the success of the Code is to have access to quality information. For this to materialize, robust utilities with state of the art technologies will swiftly need to be put in operation.

- Adjudication Infrastructure: By December 2015, almost 59,000 cases were pending before DRTs, which currently deal with recovery cases of only banks and certain financial institutions. This is despite a strict statutory prescription of 180 days for resolution of disputes in relation to recovery of debt. The major reason for clogging of pending cases is the multiplicity of proceedings and misuse of the remedy of appeal to DRAT and other forums. The Code does not take away this option and the order of the DRT and NCLT may be further challenged with DRAT and NCLAT, respectively. The appellate order may also be further challenged at the Supreme Court. Therefore, while the intent objective behind the Code is laudable, the sheer enormity of disputes/appeals in the country and the lack of infrastructure to support this legislative intent, will be a key challenge which will need to be overcome in order to achieve the intended speed.

In addition, the already over-burdened DRTs are now being assigned with the additional responsibility of adjudicating insolvency/ bankruptcy cases of individuals (which can be initiated by all creditors or the individuals themselves). A major overhaul of DRT infrastructure both in terms of physical facilities and manpower will be needed to achieve what the Code seeks. - Role of the Board: Instead of making the IPs and/or IPAs self-regulated, the Board has been assigned with the responsibility of regulating their performance and laying down the standards of performance. In most insolvency/ liquidation proceedings, government will be an interested party for recovery of the unpaid statutory dues of its several departments. This will make the impartial operation of insolvency professionals (whose entry and exit in the insolvency profession is regulated by the government through the Board) difficult. As such, for achieving the objectives of the Code and ensuring good governance of the IPs and/or IPAs, the minimum standards set by the Board should be further strengthened in practice with self-regulation.

Rehabilitation of Sick companies under new companies Act 2013 vs SICA 1985

Old Regime before Companies Act 2013

US companies - Chapter 7 Vs 11 - Liquidation Vs Rehabilitation

Salient Features of Chapter 7 bankruptcy

Withdrawal of IBC case based on consent terms

Small creditors use India's new bankruptcy rules to put the squeeze on big players - Sep 15 2017

Swedish telecom equipment firm Ericsson became the first high-profile foreign vendor to use the tool, filing a petition this week to drag Indian telecom carrier Reliance Communications to insolvency courts over unpaid dues of $180 million.

IBC Act - Case Studies

VA TECH - operational creditor

By

upholding the collective decision of the Committee of Creditors as paramount,

the apex court has addressed a key reason for long-drawn litigations under the

Insolvency and Bankruptcy Code

Between 2007 and 2014, Bhushan Power and Steel Limited (BPSL),

via its directors, got huge loans. The company borrowed all these credits to

meet working capital requirements, purchase of plant and machinery, and other

expansion related activities. The

company availed credit from 33 banks and other institutions. As a result, the

total sum stood at 47,204 crores.

While the company saw good growth and fairly reasonable profits,

they continuously skipped payment deadlines. Later on, it was revealed that the

money was siphoned and diverted to 200 shell companies.

he Punjab National Bank (PNB) moved it for solvency, demanding

the payment of dues and the borrowed sum. Bhushan Power and Steel had

availed credit of Rs 4423 crores from PNB. Following the suit put forth by PNB,

other lenders were also exposed to reality, and they went on to join the

suit.

The company was soon under the radar of the Enforcement

Directorate (ED), and a charge sheet was filed. The action was taken against

its promoter Sanjay Singal under the Prevention of Money Laundering Act (PMLA).

Along with him, a few others were taken into custody, including

certain bank officials for their part in the money laundering and its illegal

diversion. Soon, Bhushan Power and Steel Limited were declared insolvent, and a

bid requesting a proposal for the same was invited by the National Company Law

Tribunal (NCLAT).

The NCLAT was happy with the bid of JSW Steel, who was also the

highest bidder for the BPSL case. The Committee of Creditors (CoC) was also

content with a 19,700 crore repayment proposal while taking a haircut of

approximately 60% of their original loan amount.

The

ED filed an opposition in the court for offering Bhushan Power and Steel

Limited (BPSL) to JSW. However, at the end of the day, the rulings were made in

favour of JSW Steel Limited. Following the acquisition, JSW will be

the go-forward to become India's largest steel producer.

Pre-packs are referred to

as "expedited

reorganization proceedings" by the United

Nations Commission on International Trade Law (UNCITRAL), because they combine voluntary

restructuring negotiations, in which a plan is negotiated and agreed to by the

bulk of impacted stakeholders, with reorganization proceedings that are started

without delay

In

pre-pack, the defaulting company gets to submit a resolution plan rather than

creditor driven insolvency process. The board of directors need to pass a

declaration in prescribed form the company’s intention to file within a certain

period of time (not more than 90 days).A members special resolution should

approve the decision to initiate the pre-pack. The Committee of

Creditors shall, by not less than 66% of the voting shares after considering

its feasibility and viability and manner of distribution and other

requirements, approve the resolution plan.

The approved pre-pack plan

is to be filed with NCLT. NCLT has 14 days to admit or reject (if the

application is not complete) it. The moratorium kicks in from the filing date

and a public announcement of the prepack process is made by the NCLT. The

pre-pack resolution process should be completed within 120 days. The ‘process’

simply means the approval of the resolution plan (which can be different from

the base resolution plan) by creditors and its submission by the IP to the

NCLT.

The IP, along with the

usual functions during the normal insolvency resolution process seems to have

one additional function during the pre-pack process – to monitor management of

the affairs of the corporate debtor. The board, while remaining in control of

the company, is required to ‘make every endeavour to protect and preserve the

value of the property of the corporate debtor, and manage its operations as a

going concern’ (s 54H(b)). There is also an option for the creditors to apply to

change the control from management to IP, by a vote of at least 66% of the

voting shares (s54J(1)). The NCLT will approve such a request if it finds gross

mismanagement, or fraud or other issues.