STRATEGY

According to strategy guru Michael Porter, “Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value.”

Strategy is the “what” part of the equation and helps you answer the question, “What are we trying to accomplish?” Yet your business design may not be sustainable; you may have trade-offs for how you position your business with customers and competitors.

Every business has limited resources and deals with a competitive landscape. The more it does of one thing, the less it can do of another. This concept leads to tactics, or the “how” part of the equation. Your tactics help you answer the question, “How are we going to accomplish our goal?”

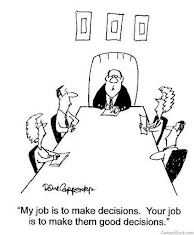

Ultimately, a good way to think about the difference between the two is that strategy acts as a guide to a set of actions that various departments or teams will undertake. The following figure further illustrates the difference between strategy and tactics.

Keep this thought in mind: What you’re not going to do is sometimes just as important as what you are going to do. For example, a company decides it’s going to target the baby boomer group, so it makes a decision to not target another generation.

Businesses use three levels of strategies in the planning process to help them grow and become sustainable. The following are three levels:

· Corporate level strategy: This level answers the foundational question of what you want to achieve. Is it growth, stability, or retrenchment?

· Business unit level strategy: This level focuses on how you’re going to compete. Will it be through customer intimacy, product or service leadership, or lowest total cost? What’s the differentiation based on?

· Business unit level strategy: This level focuses on how you’re going to compete. Will it be through customer intimacy, product or service leadership, or lowest total cost? What’s the differentiation based on?

· Market level strategy: This strategy level focuses on how you’re going to grow. Will it be through market penetration, market development, product or service development, or diversification?

What do we sell ? – “Marketing Objective”

Jugaad vs anti-jgaad -Jugaad can be reverse engineering , frugal engineering....but not cutting corners and skipping processes

Strategy Can also be simplified into the below five questions

What do we sell ? – “Marketing Objective”

To whom? Geography ? – “Segmenting & Targeting”

Approach ? - “ Positioning”

Why buy me? “USP”

How we make money while doing the above ?

Immitative Innovtion

Good artists copy, great artists steal, said Pablo Picasso, one of the 20th century's most influential artists, implying that a good artist merely reproduces a subject while a great one takes possession of it and turns it into something new. It's a maxim that many Indian startups, who have adapted ideas for services from the US and other countries, seem to live by.

In 2007, Flipkart came as the Indian answer to US e-commerce giant Amazon, and three years later Bhavish Agarwal's Ola took on US taxi aggregator Uber. Both have managed to keep the pioneer on its toes in the Indian market. And they're not alone. For every startup that was heavily funded in the US, around 50 me-too startups came up in India in the past year, vying for investors' attention, according to data from Tracxn!, an analytics firms that tracks startups.

"Ideas have always travelled around the world and anything which can be leveraged in the local market as a nature of business should not be stopped," says Ravi Kiran, co-founder of Mumbai startup accelerator Venture Nursery. "When Kishore Biyani started Future group, didn't Walmart exist?" About 100 of the 400 applications he gets for his accelerator programme talk of being "the Flipkart for XYZ market."

Kiran says no one can copy; one needs to look at market conditions and innovate. He gives the example of Ritesh Agarwal of Oyo Rooms. "Ritesh wanted to start the Airbnb of India with Oravel Stays. But, he realized the bigger opportunity lay in aggregating hotels rather than concentrating on homestays," Kiran recollects.

Agarwal agrees that his idea of creating the Indian Airbnb did not work. "With Oravel, we wanted to make a platform to enable discovery," he says. After staying in 150 guest houses and dealing with rude staff, dirty linen and bad washrooms, he realized the problem was not discovery but the lack of predictability of experience in a lower category hotel. So he turned the focus to standardizing the hotel experience, a model that is almost unique to India.

Thirukumaran Nagarajan and Sharath Loganathan's grocery delivery app Ninjacart, which they launched in January, seems, on the surface, similar to US-based Instacart. But Nagarajan says no one can just copy the US model. "You might think everyone is copying but the business models operate differently." He says each of the major players approaches grocery delivery differently. "PepperTap delivers groceries from supermarkets, Grofers has its own storage. We are tying up with local kiranas." Close to 40 startups are competing in grocery delivery, and new players are look for innovative methods to differentiate and attract customers.

In the mobile payments space, Abhijit Bose, a Harvard alumnus who worked with Oracle and Siebel Systems, started Ezetap in 2011. The Bengaluru-based payment device maker's solution appears to be along the lines of US-based mobile payment company Square. But, Bose says the only thing Ezetap has in common with Square is the core concept. "We are not Square. Everything from the distribution to the business model is different," he says. Square focuses on small and medium enterprises, while Ezetap is a solution that any merchant/retailer can use. Ezetap is more than a cardswiping machine. It has tied up with banks, and acts like a mini ATM, a software service for banks, a move that Bose and team thought was necessary in India.

Following the phenomenal success of China's WeChat, chat-based services have caught on in India, with over 30 emerging over the past year. But are they copycats? Far from it, says Pratyush Prasanna, co-founder of the two-month-old MagicTiger. "Copycat startups are not fuelling the Indian startup boom. People call us the WeChat of India, but we are not. The copycat model doesn't work. We provide last-mile delivery and it's only through fulfilment that you touch the customer," he says. Unlike WeChat, which is a communication and discovery platform, chat-based services in India enable delivery of products and services to customers. Some allow customers to chat in local languages.

Some even believe that "copying" is not a bad word. "It is fantastic if entrepreneurs are copying. If one is alone, there is no one to educate the market about your product or give you a market opportunity. Competition is great," says Arpit Agarwal, principal at early stage venture fund Blume Ventures. He is quick to add that Indian entrepreneurs are not fools to just be influenced by a trend.

He classifies entrepreneurs into three types. One is where the entrepreneur finds an opportunity to solve a problem and starts work without being swayed by trends. "The best entrepreneurs don't copy. They are driven by their own inspiration and that is validated by VC funding," he says. Second, is when VCs start funding and a number of young people start ventures in the same space. These early movers have the best chance of success. Third, are the likes of Ola and Flipkart, who scaled and executed their business model after recognizing the problems peculiar to India.

VC pressure is often the reason why entrepreneurs take the tried-and-tested route. Many investors are not open to the idea of funding a company in a new space. When Amit Kumar Agarwal went to pitch his startup idea to investors for early stage funding, he was greeted by the same questions: 'Are there any examples of this model in the West? Why hasn't it worked there?' He faced around 30 rejections before he raised $3 million from Saif Partners for NoBroker. "It's strange. Investors who are supposed to be risk takers are now risk averse," he says. His experience is echoed by many entrepreneurs who think investors are just investing in models that have worked somewhere else.

"All investors dealing with startups owe it to themselves to help entrepreneurs. Many VCs have fallen into the trap of putting the idea above the problem. When they take a risky decision, they look for assurance where they should not," says Kiran of Venture Nursery.

Rajesh Sawhney, founder of tech accelerator GSF India, says the reluctance of investors is justifiable. "Indian markets are new and Indian angels are new to this. They don't want to invest in something that hasn't worked somewhere else. But, I also know many angel investors who look at the entrepreneur more than the idea."

Sawhney sees a transition phase coming. "You cannot copy without localization. Indian consumers are different, and entrepreneurs should be able to understand consumers. That is the nature of business. As the number of startups increase, a lot more will be successful. Till then, we should welcome startups and not worry about them copying or shutting down. We should celebrate it."

Say Yes to Jugaad Jugaad in its broad sense includes the below principles

Say no to jugaad

What was being hailed as innovation in Indian industry not so long ago was nothing but cutting corners and skipping processes

On July 18, the Indian arm of General Motors informed the government that an internal probe had shown that its employees had sent for inspection new Tavera models that were fitted with engines that had already been approved in order to meet the emission standards, and that they had falsified data about the weight of the multi-utility vehicle to get away with lighter emission controls. The company suspended production and distribution of two models of the Tavera and recalled more than 100,000 units it had sold since 2005. General Motors has taken action against the employees responsible for this misdemeanour. Several senior people have been asked to leave. More heads are expected to roll.Was this an isolated lapse? Hardly. Mint reported last month, quoting information provided by the Society of Indian Automobile Manufacturers, that Indian car makers had recalled 11 per cent of the cars they had sold in the 12 months to June 2013. Those who recalled their products during the period include Toyota, Honda, Ford, Renault, Nissan and Mahindra & Mahindra. The General Motors recall will only increase that number.

Is it something restricted to the automobile space? Again, hardly. Look at the problems Indian pharmaceutical companies have had with the United States Food and Drug Administration, or FDA. Ranbaxy admitted in May that it had falsified data while seeking approval to sell its drugs in the US and paid a penalty of $500 million (Rs 2,743 crore) to close the case. The stories that tumbled out after the fiasco were startling, to say the least. Executives, it was alleged, would bring medicine from abroad in suitcases, which would be ground and repackaged as Ranbaxy medicine and then sent for approval to the FDA. The incidents relate to the time Ranbaxy was owned by the Singh brothers, Malvinder and Shivinder. They have denied any wrongdoing. But nobody contested that serious manufacturing lapses had taken place.

In June, the FDA issued a warning letter to RPG Life Sciences for violation of current good manufacturing practice norms at its two plants in Ankleshwar and Mumbai. And in mid-July, in a letter addressed to Habil Khorakiwala, the FDA said it might freeze approvals for any new launch Wockhardt was planning in the US until the company addressed its concerns about its factory at Waluj. The FDA also recommended Wockhardt hire independent auditors to review its operations at Waluj and asked the company to detail its plan for an upgrade. According to Wockhardt, the FDA import alert will cause an annual loss of $100 million (Rs 600 crore). On Wednesday, Strides Arcolab's share fell steeply after the company disclosed it had received "observations" from the FDA in June about its factories and had responded to them. In addition, there have been several product recalls by Indian drug makers in the US. In the past year or so, Ranbaxy, Sun Pharma, Cadila, Dr Reddy's Laboratories, Glenmark and Lupin have recalled some of their key drugs from the US market. Little surprise then, as Business Standard has reported, that the FDA has decided to tighten the regulatory standards; instead of one batch of medicine, companies will need to send three batches to the FDA for inspection before they can launch the drug in the US.

Both car makers and drug makers say there is nothing unusual in these numbers. The world over, manufacturing regulation is being upgraded and such things - recalls, essentially - are bound to happen at this stage. That many of the recalls have been voluntary shows that Indian industry is finally coming of age - the tendency to sweep such things under the carpet is on the decline, they argue. That may be true, but only to an extent. The number of incidents of recall and defects in India is far greater than that in other countries.

Credibility is a serious crisis Indian industry faces; of course, apart from the fact that manufacturing in the country is in decline - many Indian industrialists refuse to invest any further in the country. For the credibility gap, industry cannot get away by putting the blame on Manmohan Singh, Sonia Gandhi, Jairam Ramesh and Jayanthi Natarajan. The fault lies within, in the quick-fix approach of Indian business. Jugaad and frugal engineering, the skills that were supposed to catapult India to manufacturing greatness, have grounded the Indian story. What was being hailed as innovation not so long ago was, everybody now seems to have realised, nothing but cutting corners and skipping processes. It was shabby engineering masquerading as innovation. Industry associations have for several years talked of building the "Made in India" brand through an advertising campaign. I doubt if that alone will work. The biggest advertisement for Indian produce is the produce itself; unless it is of high quality, nobody will buy the advertising campaign.

One reason for the poor quality of Indian manufactured items is poor human resources; the challenge in recent years has become severe. A majority of those who pass out of engineering schools are unemployable, and companies that hire them are unwilling to spend on their training because the money comes straight out of their profits. In fact, thanks to the inflexible labour laws, most companies prefer to engage contract workers. This, by nature, is a low-engagement affair. The company has no interest in upgrading the skills of such workers. Most business houses pay lip service to innovation, though there are exceptions like the Tata group and Mahindra & Mahindra.

The need for excellence in manufacturing cannot be overemphasised. It is now widely acknowledged that the only long-term solution to bridge the rising current account deficit is higher and higher merchandise exports. That can happen only if the quality controls are strengthened immediately.

Management consulting - Both on strategy and tactics

Management consulting is the practice of helping organizations to improve their performance, primarily through the analysis of existing organizational problems and development of plans for improvement. Organizations may draw upon the services of management consultants for a number of reasons, including gaining external (and presumably objective) advice and access to the consultants' specialised expertise.

As a result of their exposure to and relationships with numerous organizations, consulting firms are also said to be aware of industry "best practices", although the transferability of such practices from one organization to another may be limited by the specific nature of situation under consideration.

Consultancies may also provide organizational change management assistance, development of coaching skills, process analysis, technology implementation, strategy development, or operational improvement services. Management consultants often bring their own proprietary methodologies or frameworks to guide the identification of problems, and to serve as the basis for recommendations for more effective or efficient ways of performing work tasks

The consulting industry experienced significant growth in the 1980s and 1990s, gaining considerable importance in relation to national gross domestic product. In 1980 there were only five consulting firms with more than 1,000 consultants worldwide, whereas by the 1990s there were more than thirty firms of this size.

An earlier wave of growth in the early 1980s was driven by demand for strategy and organization consultancies. The wave of growth in the 1990s was driven by both strategy and information technology advice. In the second half of the 1980s the big accounting firms entered the IT consulting segment. The then Big Eight, now Big Four, accounting firms (PricewaterhouseCoopers;KPMG; Ernst & Young; Deloitte Touche Tohmatsu) had always offered advice in addition to their traditional services, but from the late 1980s onwards these activities became increasingly important in relation to the maturing market of accounting and auditing. By the mid-1990s these firms had outgrown those service providers focusing on corporate strategy and organization. While three of the Big Four legally divided the different service lines after the Enron scandals and the ensuing breakdown of Arthur Andersen, they are now back in the consulting business.

BCG (Boston Consulting group) Matrix

Value Based Management

Recent years have seen a plethora of new management approaches for improving organizational performance: total quality management, flat organizations, empowerment, continuous improvement, reengineering, kaizen, team building, and so on. Many have succeeded—but quite a few have failed. Often the cause of failure was performance targets that were unclear or not properly aligned with the ultimate goal of creating value. Value-based management (VBM) tackles this problem head on. It provides a precise and unambiguous metric—value—upon which an entire organization can be built.

The thinking behind VBM is simple. The value of a company is determined by its discounted future cash flows. Value is created only when companies invest capital at returns that exceed the cost of that capital. VBM extends these concepts by focusing on how companies use them to make both major strategic and everyday operating decisions. Properly executed, it is an approach to management that aligns a company's overall aspirations, analytical techniques, and management processes to focus management decision making on the key drivers of value.

VBM is very different from 1960s-style planning systems. It is not a staff-driven exercise. It focuses on better decision making at all levels in an organization. It recognizes that top-down command-and-control structures cannot work well, especially in large multibusiness corporations. Instead, it calls on managers to use value-based performance metrics for making better decisions. It entails managing the balance sheet as well as the income statement, and balancing long- and short-term perspectives.

Some of the terminology is intriguing and thought provoking. One such word is

Management consulting Jargon : MECE

Management consulting firms like McKinsey, Bain and the Boston Consulting Group use a wide variety of jargon , tools and techniques while analysing a given problem and arriving at a solution.

Some of the terminology is intriguing and thought provoking. One such word is

Mutually exclusive collectively exhaustive

It is a grouping principle for separating a set of items into subsets.

Examples of MECE arrangements include categorizing people by year of birth (assuming all years are known). A non-MECE example would be categorization by nationality, because nationalities are neither mutually exclusive (some people have dual nationality) nor collectively exhaustive (some people have none).

Advisor vs Consultant

Consultants are problem solvers. Advisors are better problem-definers than solvers. At their best, they contribute to strengthening their clients capacity to solve their own problems.

Advisors can provide an early-warning about emerging problems, signals often missed by a consultant's sharp focus on eliminating the problem at hand.

Organisations call on consultants when they have a clear cut problem in need of solution.But when people already has thought through several possible solutions they need advisor to serve as an impartial sounding board, a sparing partner to help test his ideas and then identify the pros and cons of proposed courses of action.

Change

In 1998, Kodak employed 1,70,000 employees and sold 85% of the world's photo papers. Within the last few years, digital photography made them out of the market. Kodak went bankrupt and all his staff came on the road. .

In 1998, Kodak employed 1,70,000 employees and sold 85% of the world's photo papers. Within the last few years, digital photography made them out of the market. Kodak went bankrupt and all his staff came on the road. .

HMT (clock)

BAJAJ (scooter)

DYANORA (TV)

MURPHY (radio)

NOKIA (Mobile)

RAJDOOT (bike)

AMBASSADOR (car)

Friends,

There was no shortage of quality at all, yet they were out of the market !!

reason???

They have not changed over time. !!

You have an idea that in the coming 10 years, the world will change completely and 70 to 90% of the people running today will be closed.

Welcome to the 4th Industrial Revolution ...

Uber is just a software. He does not have a single car of his own, despite this he is the world's largest taxi company.

Airbnb is the world's largest hotel company, while they do not have a single hotel of their own.

There are many examples like paytm, ola cabs, oyo rooms.

There is no work left for young lawyers in the US now because the software named IBM Watson gives better legal advice throughout the moment. In the next 10 years, 90% of Americans will become unemployed ... who will save 10% ... they will be Super Specialists.

The software named Watson is diagnosed with 4x Accuracy of Cancer compared to humans. By 2030 the computer will be more intelligent than humans.

By 2018, Driverless cars will land on the roads. By 2020, this single invention will start to change the whole world.

90% cars will disappear from the streets of the world in the next 10 years ... Those who will survive will either have electric cars or hybrid ... roads will be empty, consumption of petrol will decrease by 90%, all Arab countries will become bankrupt .

You will request a car from a software like Uber and in a few moments, a driverless car will be parked at your door ... if you share it with someone, that ride will be cheaper than your bike.

Due to being a driverless of cars, 99% of accidents will stop. This will stop the business of Car Insurance.

No employment like a driver will survive on earth. When 90% cars will disappear from cities and roads, problems like Traffic and Parking will end automatically ... because a car will be equal to 20 cars today.

From today 5 or 10 years ago, there was no such place where there is no PCO. When the mobile phone arrived, the PCOs had to shut down. The PCO people started selling the mobile phones. Now the recharge is also going online.

Have you ever noticed ..?

Today, every third store in the market is a mobile phone store which does

sale, service and maintenance of phones and it's accessories..

Almost all payments are done by Paytm today ..

People have started booking railway tickets with their phones. The transaction of money is also changing. Currency Note was replaced by Plastic Money and now it's

Digital...

Hence...

Every Person should continue to make changes in his business or his / her way of working and should also change his / her nature over time for Good.

"Keep Updating / Upgrading Your Skills and Knowledge with Time"

The world is changing very fast ..

Keep Your eyes and ears open or else you will lose ...

Be prepared to change with time.

Run with time and

Be Successful.🙏🌹🙏

Management & Leadership

Change Management

Management & Leadership

Change Management

*THE COBRA EFFECT*

The Cobra Effect is a term in economics. It refers to a situation when an attempted solution to a problem makes the problem worse.

This name was coined based on an incident in old colonial India.

By some reasons, there were too many venomous cobra snakes in Delhi. People were dying due to snake-bites and it became scary for almost everyone to step out of their houses.

The government of the day had to get into action to stop this menace and it offered a silver coin for every dead cobra. The results were great, a large number of snakes were killed for the reward.

Eventually, however, it led to some serious unwanted consequences. After a short-term dip in cobra population, it started going up.

This was because few people began to breed cobras for the income. When the news reached the government, the reward program was scrapped, causing the cobra breeders to set the now-worthless snakes free. As a result, the cobra population further increased. The solution for the problem made the situation even worse.

The unintended consequence for a well-intention-ed idea led to making the problem worst.

Trying a new solution?

or

Planning to tackle an existing problem with a new idea?

Well, it's time to pause and think about how people would respond to the new idea that may sound great on paper!

Specially the solutions that try to affect how people behave.

Every solution has consequences and those consequences may lead to certain situations where rather than solving a current problem, you may end up with more complex problems.

As they say the road to hell is paved with good intentions, the similar mistakes are happening around us everyday when the decision -makers fail to take a 360 degree view of all the possible outcomes of an action before implementation.

Nearly 2 years ago, city of Philadelphia in USA passed a "soda tax" -- a US $1 tax on a typical 2-liter bottle of soft-drink- as a "sin tax" in the national war on obesity. But the natives didn't cut calories as a result of the tax on sweetened drinks, nor there was a shift towards any healthier option. Instead, most of them just drove outside the city to buy the same colas , from stores where they didn't have to pay the tax. But the poorest paid more as they could not find it affordable to drive out of the city to buy their drinks. In the end , city suffered loss of revenue due to lower sales whereas the lower section society paid more .

The unintended consequence for a well-intentioned idea led to making the problem worst.

Even big & brilliant companies do the same mistake!

It is not that mistakes happen only with the government run programs, there're n numbers of examples in great private companies too where the best & brilliant people lose sight of certain negative outcomes due to the initial magic of seemingly great looking ideas .

The Nano Car - a small car that could never it make it big !

The car once touted as the world's cheapest, Tata Nano, seems to be running into a dead end as sales and production is down to a trickle. The poor demand has resulted in Tata Motors shutting down the plant few months back.

.

A car considered as a brilliant product, launched in a segment having a billion dollar opportunity. Hope ran high , the company expected all present and potential two-wheeler owners would shift to Nano.

But they forgot to dwell deeper – a car marketed as 'the cheapest car' , created huge initial interest. But it never took off.

Later on, Ratan Tata admitted that the reason for failure of this idea was none other than the term which became synonymous with Nano – "The cheapest car".

Buying a car in India is associated with social status and prestige; if a person owns a car, he is assumed to be successful and settled. But the word 'cheap' in its marketing campaigns spoiled everything.

The company also failed to dwell upon the competition from used-cars. Used cars (2nd hand cars) from other companies , which were much better in quality, space

and mileage were available to the same customer -segment at the same or lesser price than Nano .

An intelligent team of people failed to think about the above likely outcomes because it became temporarily blind by the brilliance of such a great idea, by the idea of tapping a billion-dollar opportunity.

Apple turning sour!

In 2017 Apple admitted that it was slowing down the speed of old iPhones as the batteries of those old phones were degrading with the passage of time.To make up on loss of brand image and to saistfy its erstwhile customers, it offered to cut its US $79 battery replacement feed down to US $29 as a way of apologizing.

This lower fee led to more people in 2018 ended up swapping their batteries — instead of upgrading to the latest iPhone models thus affecting new iPhone sales. As iPhone batteries became cheaper and easier to replace, fewer people are shelling out for new iPhones that can now cost up to US $1,449.

On January 2nd this year, Apple revealed that it was expecting a $9 billion loss in revenue due to weak iPhone demand that's partly caused by more people replacing their batteries, according to a letter issued by CEO Tim Cook addressed to investors.

Slowing down of iPhones sales can be attributed to many external reasons too (better Chines phones, better Apps on Android phones etc ), but strategy of battery-replacement was an internal idea. It would have been handled better if people at top would have thought more about it , if they would have filtered this program from Cobra effect

"What's in it for you ?

Next time if you or your team has some brilliant idea , get your brilliant guys together in a room and think about the Cobra- effects before implementing that idea,

You can always fine-tune the idea to minimize the negative implications by spending few extra hours/days before rushing to announce it,

Don't implement while you're under the awe of the brilliance of a never -tested, nice-looking solution or idea, think about the Cobra-effects first."

Change VS Transformation